Ever since Ethereum took the blockchain concept that Bitcoin introduced and built an app platform for blockchain, several others have tried to do the same thing. One of the most prominent “Ethereum alternatives” is NEO, an open source Chinese project that hopes to build a “smart economy” using blockchain technology.

Like Ethereum, NEO has built its own blockchain and offers it to third party developers to build on. Here on Blocksplain, we’ve already written about one of those third parties: Narrative, an upcoming ICO that is developing a content network using NEO’s blockchain.

Also like Ethereum, NEO uses smart contracts as a programming layer on top of its distributed ledger. NEO promotes two other key aspects of its platform: Digital Assets and Digital identity. The basic idea is that you can create a digital version of any physical asset and, once you’ve verified your own digital identity, specify actions to be carried out on that asset using smart contracts.

But NEO isn’t simply an Ethereum copycat, as you’ll discover in this post.

NEO was founded just a year after Ethereum, in 2014, and it has since developed its own unique properties. The project was originally named Antshares, but switched to its current hip, Matrix-influenced, name in June of last year. At its recent DevCon event in San Francisco, NEO founder Da Hongfei (pictured above) referenced the movie when he said that NEO aims to be “the one” blockchain.

Hang on, what’s a smart economy?

The term “smart economy” sounds like the kind of buzzword we’ve heard a lot in recent years, for example in the Internet of Things market. But what does a “smart economy” mean in the blockchain context? Noam Levenson explained it well in a comprehensive article on Hackernoon:

A smart economy will feature digitized physical assets. All of these newly digitized assets will have proof of ownership in the blockchain. These assets can be sold, traded, and leveraged through smart contracts. Their ownership can be protected and validated through the decentralized model of the blockchain.

By “asset” it means anything you can think of that has a value – a house, car, toaster, and so on.

In a nutshell, in NEO’s world every asset is recorded on the blockchain and ownership is verified. Which means these assets can now be traded, and more, in this “smart economy.”

Key differences from Ethereum

The biggest difference in my opinion is that NEO has been built to comply with government and business regulations. NEO’s blockchain can be easily overseen by authorities. This makes it ideally suited to thrive in the East, and in particular its home country China. Ethereum on the other hand comes from the libertarian view of Internet platforms, common in Silicon Valley and Europe, so it emphasizes aspects like decentralization and individual privacy.

Why is NEO able to be overseen so easily? Because every asset and person in NEO will be recorded on the blockchain. One consequence of this is that NEO enables governments to control precisely what goes on in an economy. Here’s where we must always remember that NEO comes from China, a country well known for exercising control over the Internet.

Ultimately, whether you see NEO’s framework for regulatory compliance as a positive or negative attribute will depend on what your stance is on individual freedom and privacy. It’s fair to say that NEO is not the usual libertarian blockchain project that we see coming out of the West.

Scalability has been the biggest issue for public blockchains, and NEO appears to have a decided advantage over Ethereum here. Narrative CEO Ted O’Neill noted this was a big reason why it switched platforms, from Ethereum to NEO. “Currently, Ethereum can process 15 transactions per second, while NEO can handle up to 10,000 per second,” wrote O’Neill.

Another key difference is that NEO works with a “proof-of-stake” consensus validation model, rather than the proof-of-work which Ethereum still has. What this means is that blocks in NEO are validated by nodes that stake their own money on the outcome. Whereas with proof-of-work, miners have to solve computationally intense mathematical puzzles – which is a huge waste of electricity. Ethereum does plan to move to proof-of-stake as well, but NEO already has this implemented.

NEO’s ecosystem

So who’s building on top of NEO, other than Narrative? As of now there appear to be just over 30 startups building on NEO, according to this NEO ICO tracker by @ByteSizeCapital.

One thing NEO has done extremely well so far is attract a developer community. Partly that’s because in NEO, developers can use the programming languages they already know – .NET, Java, Python, JavaScript and more. Whereas on Ethereum, developers have to learn a new language: Solidity.

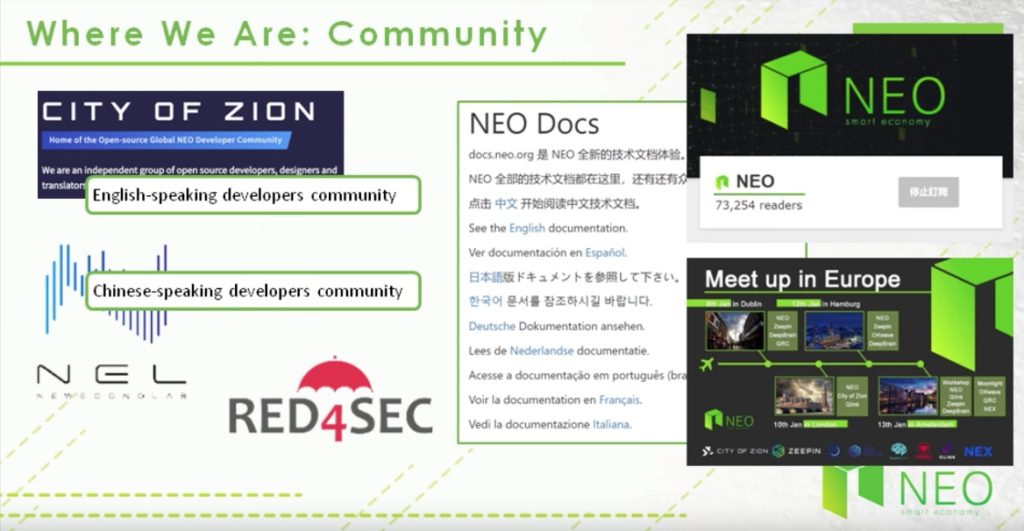

The brilliantly named City of Zion (CoZ) says it is “an independent, international group of open source developers working on NEO blockchain.” Its the main english-speaking developer community for NEO and its projects include a NEO wallet and a block explorer named NeoScan. So there’s a lot of activity already in the NEO ecosystem, which is a promising sign.

NEO has also been smoothing palms in the West. It hosted a series of meetups in Europe over January, followed by the inaugural NEO DevCon in San Francisco at the end of last month.

Conclusion

NEO is a force to be reckoned with in the emerging blockchain ecosystem, due to its vibrant developer community and inherent ability to comply with government and business regulations.

However it should be noted that Ethereum has also buddied up to big business, with the Enterprise Ethereum Alliance. With partners like Microsoft, Mastercard and JPMorgan, Ethereum is more than capable of holding off NEO’s challenge on the business front.

I suspect a lot of NEO’s future in the West will depend on whether Ethereum drops the ball in 2018 or 2019, as it seeks to implement proof-of-stake (a critical change) and meets other governance challenges.

Let’s not forget also that NEO has yet to experience the scaling issues that Ethereum has had to deal with. When NEO gets hundreds of ICOs trying to launch products on the NEO blockchain, then we’ll see how good its technical platform really is.

One more thing. I for one am not underestimating the importance of Vitalik Buterin, Ethereum’s founder and resident genius. With all due respect to NEO founder Da Hongfei, I didn’t come away from his DevCon presentation thinking he was a once-in-a-generation entrepreneurial wizard. But whenever I watch a Buterin video, I’m always awed.

Will NEO become “The One” by 2020? Probably yes in China and perhaps even the whole of Asia. But I don’t see it happening in the West, where Ethereum already has a big foothold with the powers that be. However, I think top 3 is on the cards for NEO. Its technical platform and developer community is on a roll, and it’s hard to see that momentum being stopped. If I was a betting man, I’d say number 3 by 2020. What say you?