There are some wild claims going round about how much ICOs raise. Sometimes it’s difficult to verify if a company actually did raise the amount of money they claimed.

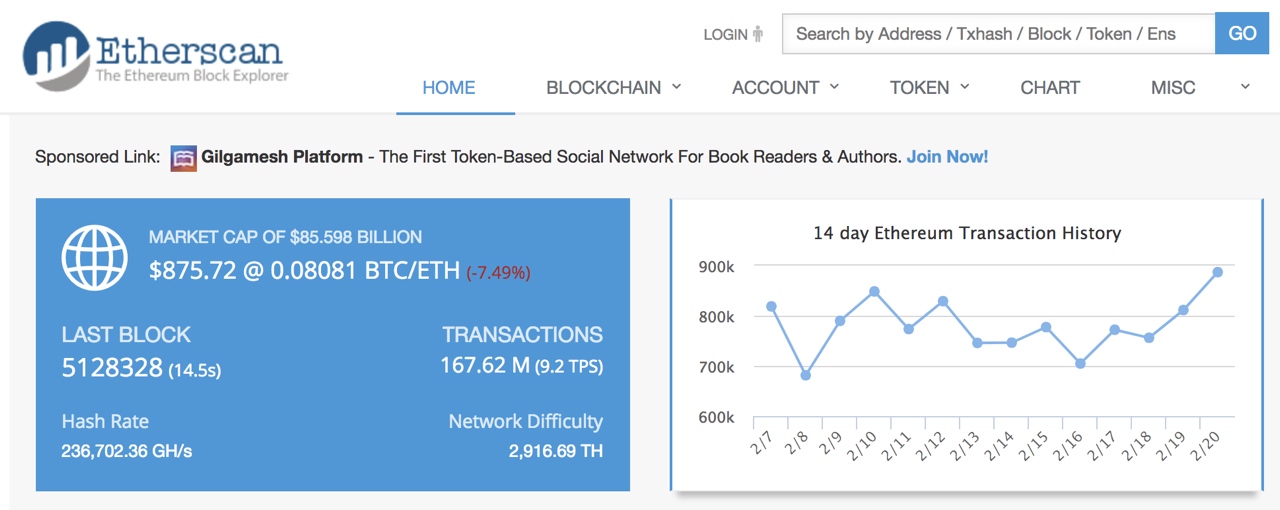

Fortunately there is a tool available to examine Ethereum blockchain transactions, which is where most ICOs raise their money. It’s called Etherscan and in this post I’ll go through an example of how to use it.

Before I start, my thanks to Daniel Shannon for walking me through the following example via email.

We’ll use the example of SingularityNET’s ICO, which took place last December. I profiled SingularityNET last week and concluded that they were a promising and solid-looking startup. This assessment of the company is further solidified when we look at that ICO’s transactions on Etherscan.

But first let’s check what SingularityNET promised. In late November, it announced a token sale of 500 million AGI tokens. Approximately 350 million of those were sold in a pre-sale, to “strategic partners in AI and early supporters over the last 8 months.” That left 150 million up for sale in the public token generation event. The price for 1 AGI token was approximately $0.10 USD and would have to be paid in Ether (ETH).

The company imposed a limit of 5 ETH per user and also announced a hard cap of US$36 million (meaning it wouldn’t raise more than that).

Now let’s go to Etherscan to try and see the transaction flow. If you type “SingularityNET” into Etherscan’s search box you’ll be directed to this page.

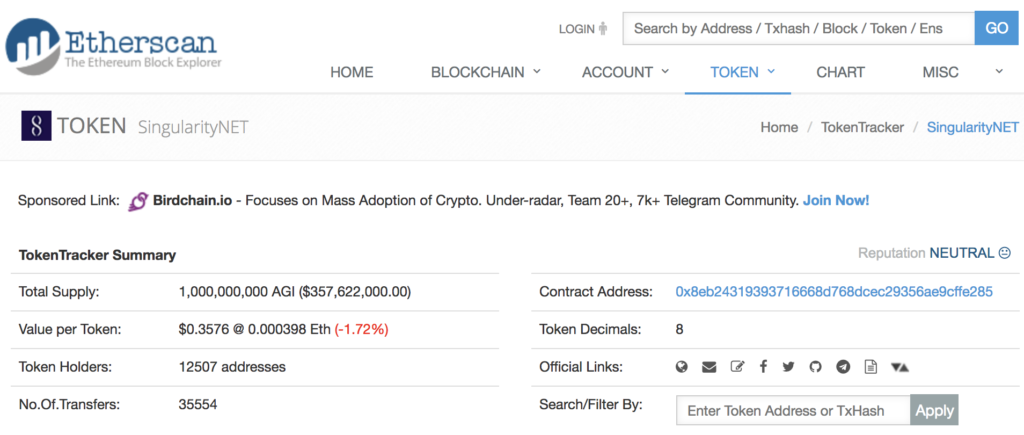

Firstly, note how easily identifiable the transactions are to SingularityNET. Believe it or not, this isn’t always the case – some ICOs you’ll struggle to find any identifiable data in Etherscan. But here you can clearly see that there are about 12,500 token holders of AGI and the total token supply is 1 billion.

Also note the Contract Address. An above-board ICO will be performed on a public blockchain (in this case, Ethereum) and the contract address should be published. That allows external people – and the media – to check and verify the details of the ICO. Again, some ICOs either don’t do their token event on a public blockchain, or they do not tell us their contract address. Either case makes it very difficult to verify the amount they claimed to raise.

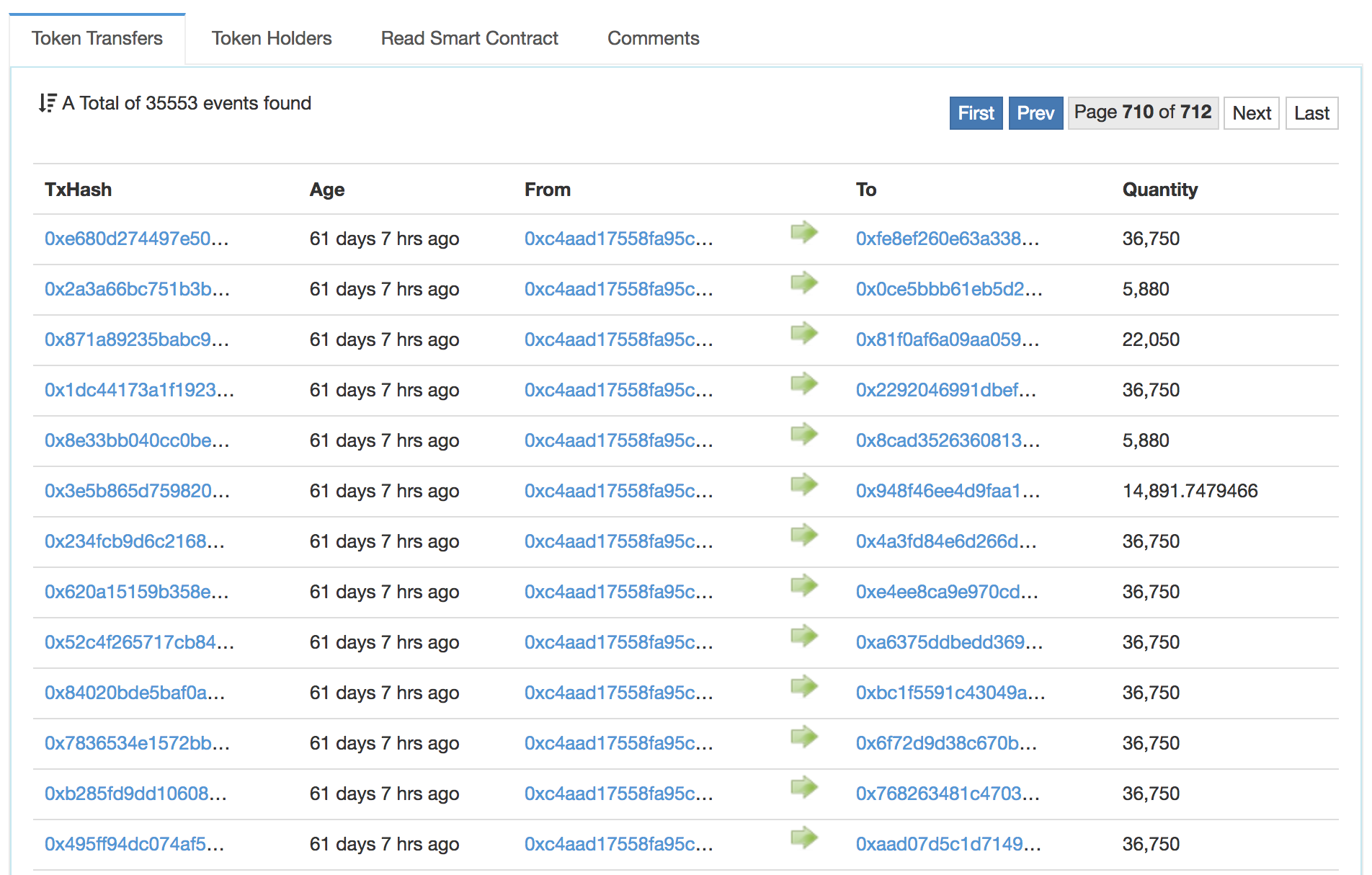

Now let’s go to “Token Transfers” and click the “Last” button (on the right) to see the first lot of transactions, which were the opening buys of AGI in the token sale. If you scan through the last five or so pages, you’ll see the number 36,750 recur. Since there’s nothing over that number, that must’ve been 5 ETH worth of AGI. So the price of ETH at that time, at least for the purposes of purchasing AGI, was US$735.

If you keep scanning through the pages, you’ll see that the transactions seem to match up to what the company promised to sell.

Although checking Etherscan isn’t a guarantee that an ICO made what they claimed, because other numbers can always be fudged, it’s a way to check the transaction flow. If that looks good and other aspects of the ICO pass muster – see Tips for assessing an ICO – then Etherscan helps to verify the company.

In this case, I’m pretty confident that SingularityNET sold what they claimed and in the manner they outlined (i.e. maximum of 5 ETH per user).

The ICOs to be wary of are the ones where you cannot find solid data about what they supposedly raised. It’s all about transparency and if an ICO doesn’t disclose their transaction data, then something fishy is probably going on.