The initial wave of Bitcoin interest came from people who wanted to spend it. That, after all, was what Bitcoin was designed for. The title of Satoshi Nakamoto’s 2008 white paper was “Bitcoin: A Peer-to-Peer Electronic Cash System.” So Satoshi’s goal from day one was for Bitcoin to be a medium of exchange.

Fast forward ten years and Bitcoin is now commonly viewed as a “store of value,” rather than a medium of exchange. Bitcoin = digital gold is the mantra of crypto enthusiasts. But while Bitcoin is no longer viewed as electronic cash, two of the top five cryptocurrencies in CoinMarketCap are staking a claim to be exactly that: Bitcoin Cash and Litecoin. The question is, when can we buy a cup of coffee with either one?

Let’s quickly summarize why Bitcoin failed to establish itself as electronic cash. It certainly wasn’t through lack of effort, because early users attempted to make Satoshi’s vision a reality. In May 2010, Bitcoin developer Laszlo Hanyecz bought two pizzas with 10,000 bitcoins. At the time that was worth about $40, but now of course it’s astronomically higher:

The #Bitcoin pizza is worth $92,212,100 today. (+1% from yesterday)

— Bitcoin Pizza 🍕 (@bitcoin_pizza) March 22, 2018

So that’s one of the problems Bitcoin faced in becoming digital cash: it got too damn expensive. The other problem was Silk Road. Yes, it became a medium of exchange…for drugs and other illicit goods on the Dark Web. When Silk Road’s founder Ross Ulbricht got taken down by the US government, Bitcoin’s reputation as electronic cash became tarnished for years.

Despite these obstacles, within the Bitcoin community there continued to be believers in Satoshi’s original vision. However, along with Bitcoin’s growing value and demand there was an equivalent increase in transaction fees and block validation times. Finally, during 2017, these factors made it unworkable to use Bitcoin as a medium of exchange. That led to a schism in the Bitcoin community, which eventually led to a hard fork.

On August 1, 2017, Bitcoin Cash (BCH) was created. As the name implies, it was designed to be used (once again) as a form of electronic cash.

Litecoin (LTC) has similar goals, but surprisingly it was born many years before Bitcoin Cash. Charlie Lee released Litecoin on October 7, 2011. It too was a fork of Bitcoin, although not a hostile one like Bitcoin Cash.

You’d think that Bitcoin Cash and Litecoin would primarily be competing against each other. But curiously, Bitcoin Cash seems to think its main competitor is Bitcoin itself. Indeed, it wants to be Bitcoin, at least from a branding point of view.

The logos of Bitcoin Cash and Bitcoin are almost identical (in BCH the B leans to the left, while in BTC it leans to the right). But worse, the most prominent supporters of Bitcoin Cash are prone to referring to their currency as simply “Bitcoin,” while they somewhat dismissively label the original as “Bitcoin Core.” This prompted Litecoin creator Charlie Lee to call out his Bitcoin Cash equivalent, Roger Ver, last month:

Roger @rogerkver, please stop calling Bitcoin, Bitcoin Core. No one else does this. Both https://t.co/VKB9ZGgQk8 website and mobile wallet are misleading new users with this bullshit. And it is especially hypocritical coming from you seeing how upset you are with the name bcash. https://t.co/ufjJDqDW1W

— Charlie Lee Ⓜ️🕸️ (@SatoshiLite) February 13, 2018

Another notable Bitcoin Cash proponent is Craig Wright, who may or may not be part of Satoshi. Here’s his latest pinned tweet, which he wrote earlier today. Note that the “Bitcoin” he refers to here is actually Bitcoin Cash:

I don't care if you love me or hate me. I care if you USE bitcoin.

Bitcoin is p2p electronic cash.

That is use.

If you don't use it, why the hell are you here?

My one goal is to have 5 billion people using bitcoin. To bank the unbanked.

If you don't think I can do it.. watch pic.twitter.com/oH9HBm5HAE

— Dr Craig S Wright (@ProfFaustus) March 22, 2018

In any case, politics aside, which is the better medium of exchange: Bitcoin Cash or Litecoin?

As you’d expect from two forks of Bitcoin, BCH and LTC share many similarities. For instance, they both use a proof of work blockchain consensus mechanism. Just as Satoshi decreed. There are some key technical differences, but I’d prefer to look at it from an end user perspective.

If you wanted to use one of these currencies to buy a cup of coffee, which would be better?

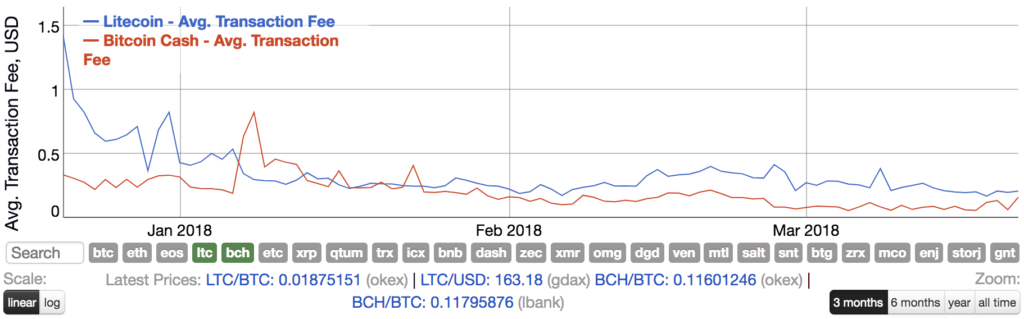

Transaction fee is one of the first key indicators. As the below chart from BitInfoCharts shows, both have average transaction fees of less than half a cent – lower than Bitcoin (BTC) and with less volatility. In January it was pretty even between BCH and LTC, but over the past couple of months Bitcoin Cash has had a slight edge over Litecoin in terms of lower fees.

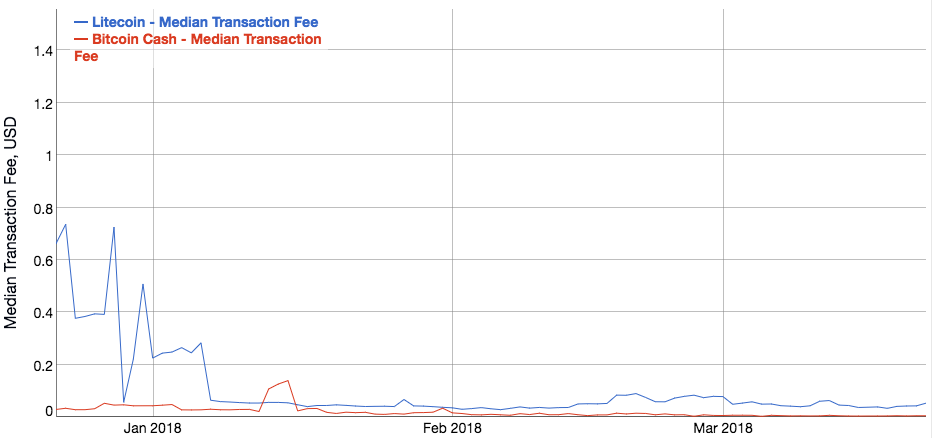

Bitcoin Cash also has the advantage in median transaction fee:

What about the time it takes for a transaction to be processed? After all, you don’t want to be waiting around for that cup of coffee.

Here, Litecoin has a distinct advantage. It takes about 2.5 minutes for a block to be completed in Litecoin, compared to about ten minutes in Bitcoin Cash.

It should be noted that a longer block time isn’t necessarily a big disadvantage for Bitcoin Cash. It takes days for a Visa transaction to be properly verified, and Visa transactions can be reversed at any time. Despite this, shops use Visa because they trust the banking system to take care of them. Cryptocurrencies are a long way from that level of trust (in the network). But even so, a ten minute block time doesn’t seem like a deal breaker.

Indeed, Bitcoin Cash is already promoting coffee as a use case. This video points out that using BCH over Visa would be much cheaper for retailers.

Conclusion

The reality is that neither Bitcoin Cash or Litecoin has much adoption yet from merchants. It may even end up being Bitcoin (the original one) that retailers flock to, since its recent implementation of the Lightning Network enables faster and cheaper transactions.

Another alternative is that the big coffee retailers release their own tokens. Starbucks has been making noises along those lines.

Ultimately, due to the volatility of all cryptocurrencies – including BCH and LTC – I’d rather just use cash or Visa for now. But I’m hoping that changes soon, because I think this Satoshi character was onto something.

Disclosure: at time of writing, I own some LTC.