Augur is a good way to begin my ongoing series of blockchain startup profiles, because this project started well before the ICO craze of 2017. Indeed, it was one of the first independent Ethereum projects to get off the ground.

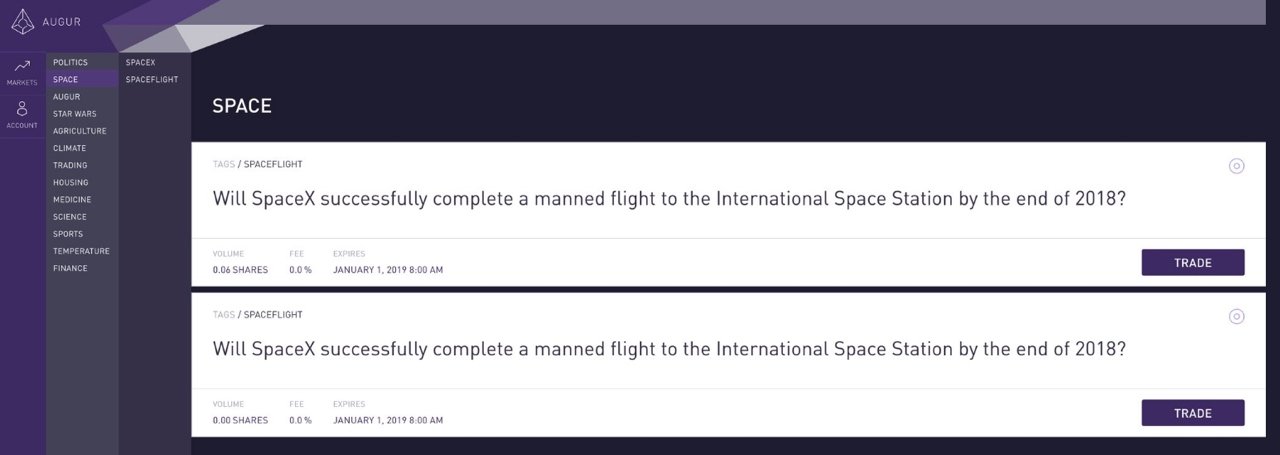

Augur is a prediction market tool built on the Ethereum blockchain. It was founded in 2014, with the goal of enabling people to “create and speculate on derivatives at a low cost.” The basic idea is that someone can make a prediction – for example, that Roger Federer will end his career with 22 Grand Slam titles – and then you and others can bet on it. What makes this an intriguing blockchain project is that reporting on whether the prediction has come true or not is decentralized.

Augur did an ICO back in August and September 2015. They raised what today would be considered a modest sum of $5.2 million, by way of their REP token. REP stands for “reputation” and here’s how it will be used within Augur: after the timeframe for a predicted event has passed, a crowd of people will report the outcome using their REP tokens. If they provide correct input, they get a share of the market fees for that prediction. But if they provide incorrect data, they lose their REP.

Note that the token, REP, is not required to actually create a prediction or to bet on the predictions that others make. For that you will use ETH (Ether). As a StackExchange user put it, “only people interested in reporting in exchange for fees or people looking to dispute a reported outcome need to hold REP.”

If all goes well, this incentivized reporting method ensures Augur’s prediction market is nearly always accurate. Even if someone deliberately lies in their reporting, other users can effectively cancel them out by disputing it. So according to Augur, their model is an example of “Wisdom of the Crowd” (a term borrowed from the Web 2.0 era).

That was my simplified version of what Augur is, but this company video explains the nuances:

Of course the risk is we don’t know for sure if this system will work in the wild, since Augur has yet to release its final product. It’s currently undergoing audits, to check that the platform is secure and functioning as it should. The test platform is available at app.augur.net, although it has been buggy so far from my limited usage. [as at time of writing, it is displaying a “network mismatch” error: “The network set on the connected ethereum node does not match the contract network.”]

While it’s been slow going for Augur’s development, to its credit the company keeps everyone up to date with regular blog posts. The project is open source, so you can even download the code from Github. For those of us less technically inclined, Augur maintains a documentation page – a useful work-in-progress document to check on from time to time.

Crucially, Augur’s developer community seems to be active on StackExchange and Reddit. This is a good sign that something credible is being built (and as we’ll see as this startup profile series develops, that isn’t always the case with blockchain projects!).

On its Reddit forum, Augur has a regularly updated status list. There’s no go-live date noted, which is a source of frustration for some redditors. However, the final item on its task list gives an indication that the Augur team is willing to eat its own dogfood:

Live launch with a bug bounty market “Will this market be hacked?”

Clearly Augur is giving itself the best odds possible of winning that bet, by doing multiple audits and security checks.

As with most blockchain projects that are in development currently, it’s difficult to know how viable the Augur platform will be once it finally goes live. But the fact that its founders and development team seem solid, its code is open source (so any other developer can check it), and it keeps its community in the loop with progress, are all positive signs. I can’t wait to use the final product.